Innovative Software, always within reach!

Our professional team of experienced software developers can help you build the modern web/ mobile apps you need.

Scale Your Business with Professional Outsourcing Services Now!

Scale Your Business with Professional Outsourcing Services Now!

We offer a comprehensive range of services

We offer a comprehensive range of services including

Product management and architecture,

Project management,Software development, and ongoing maintenance and support.

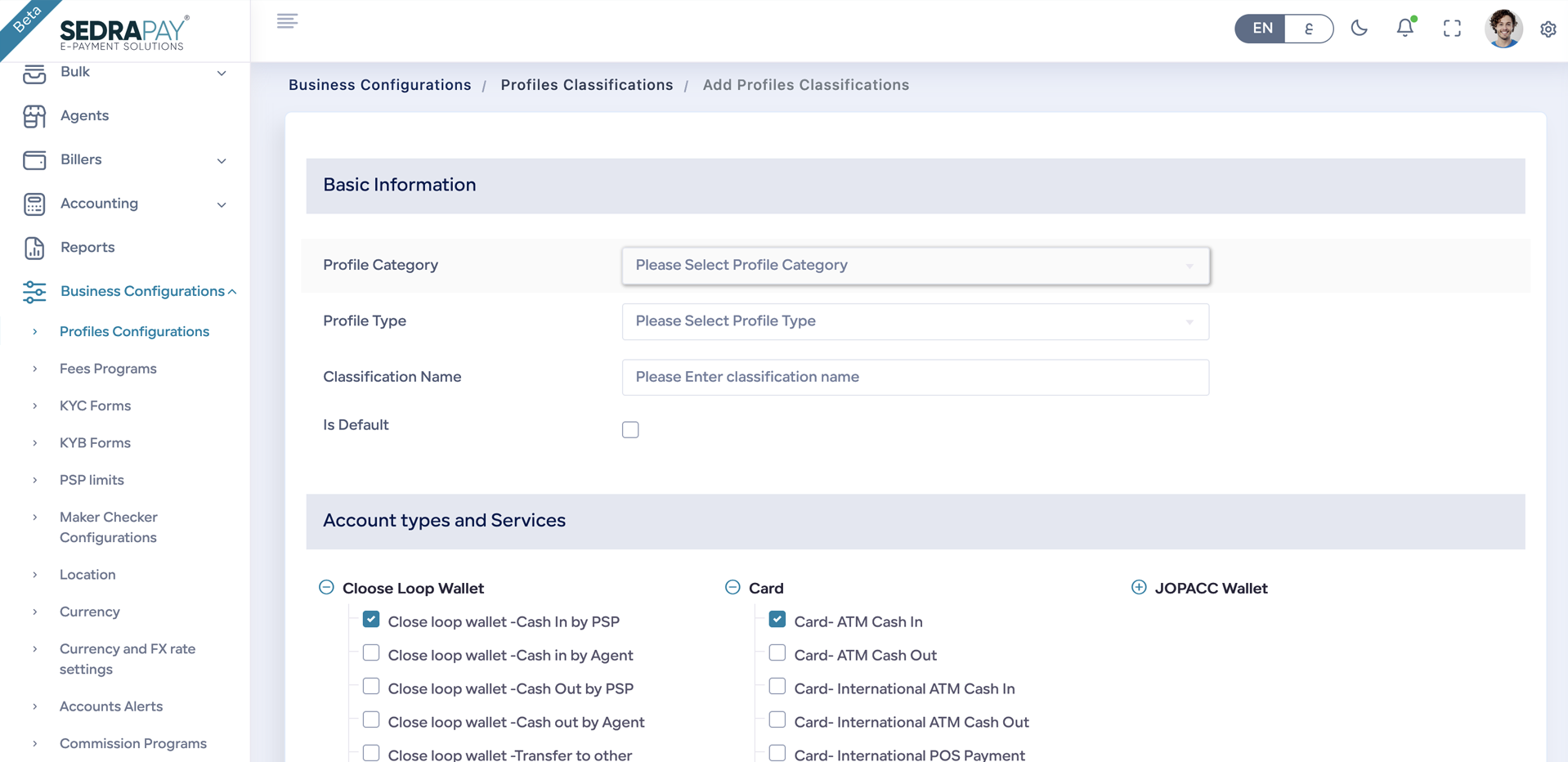

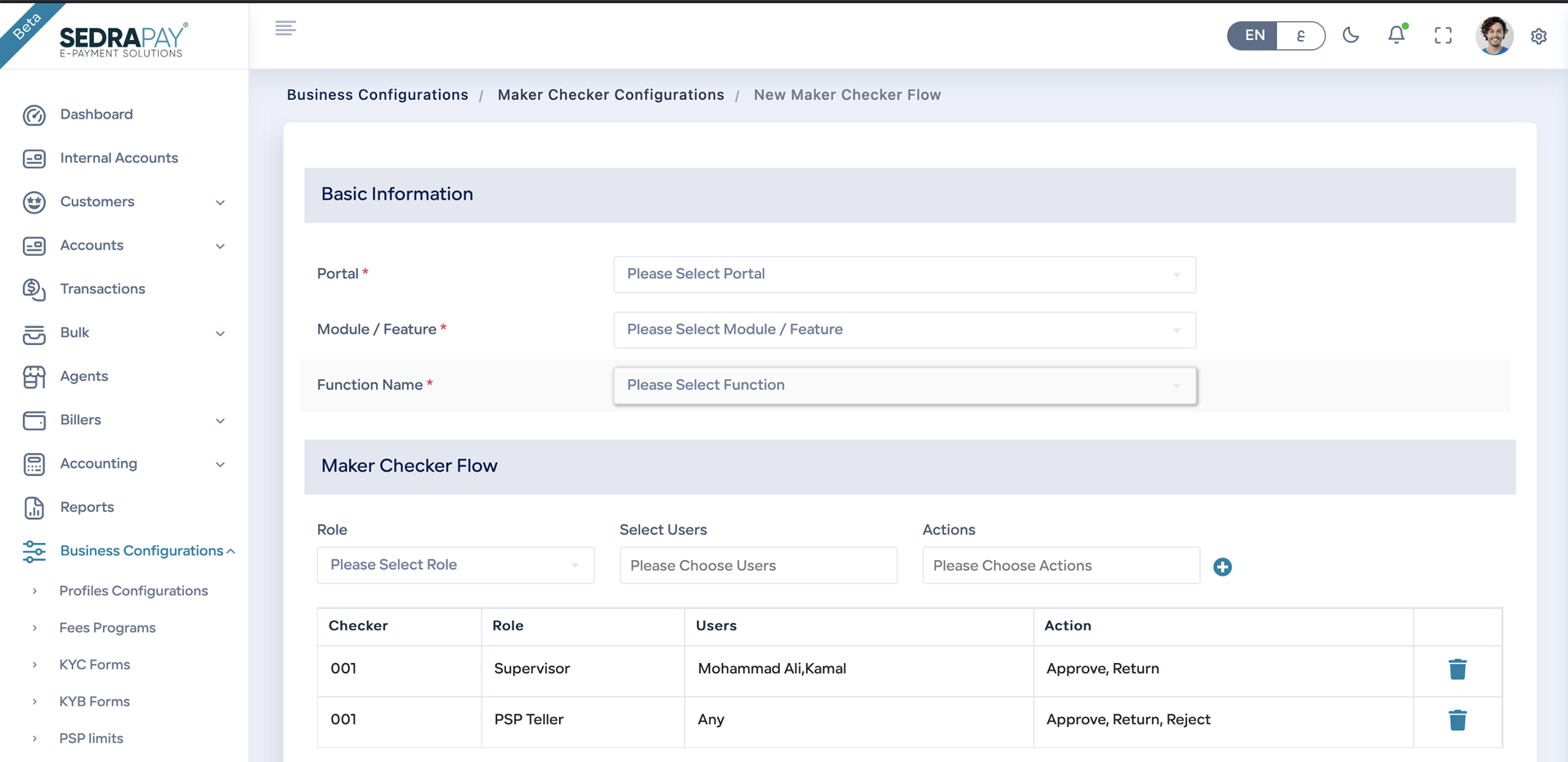

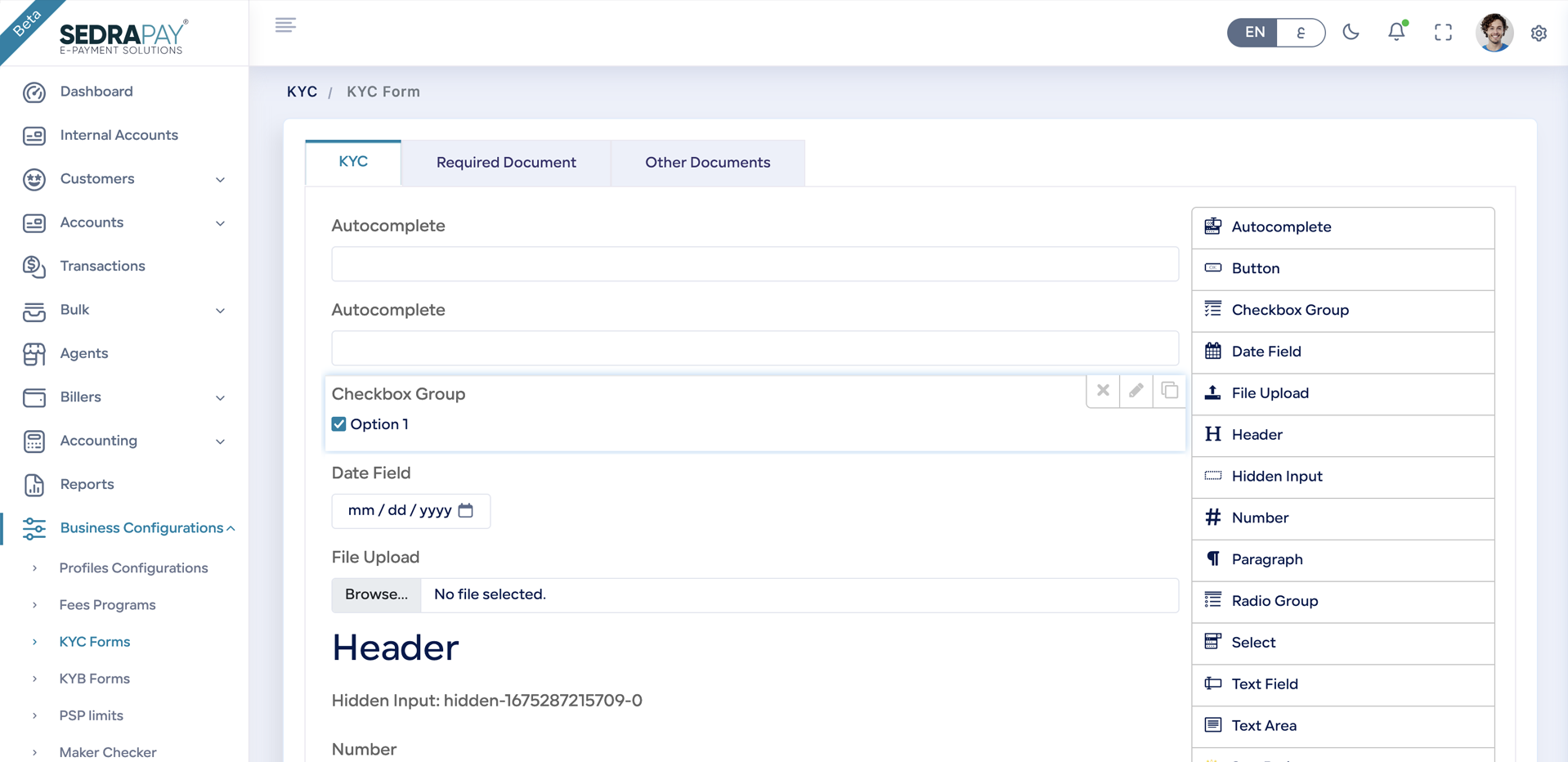

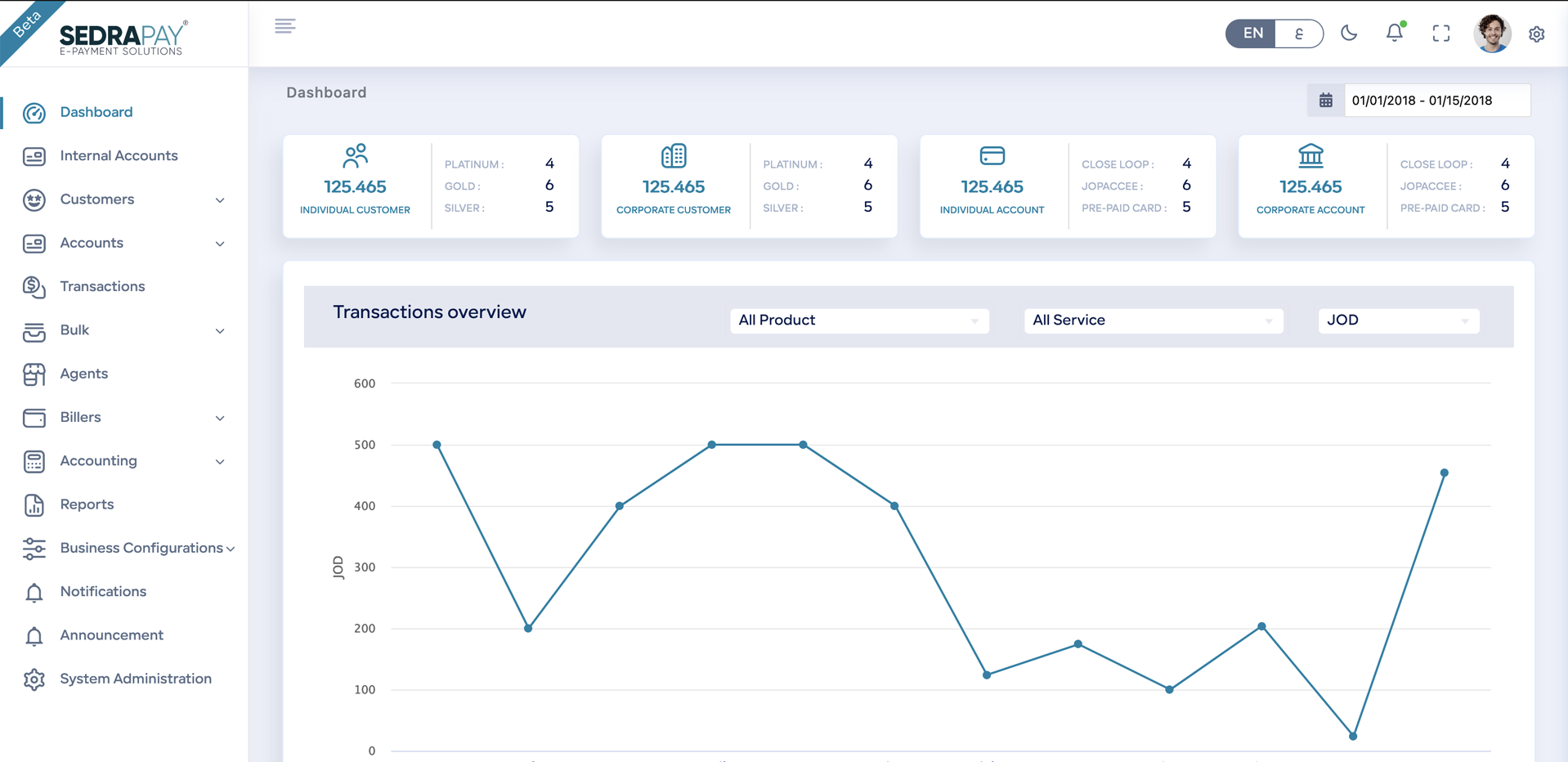

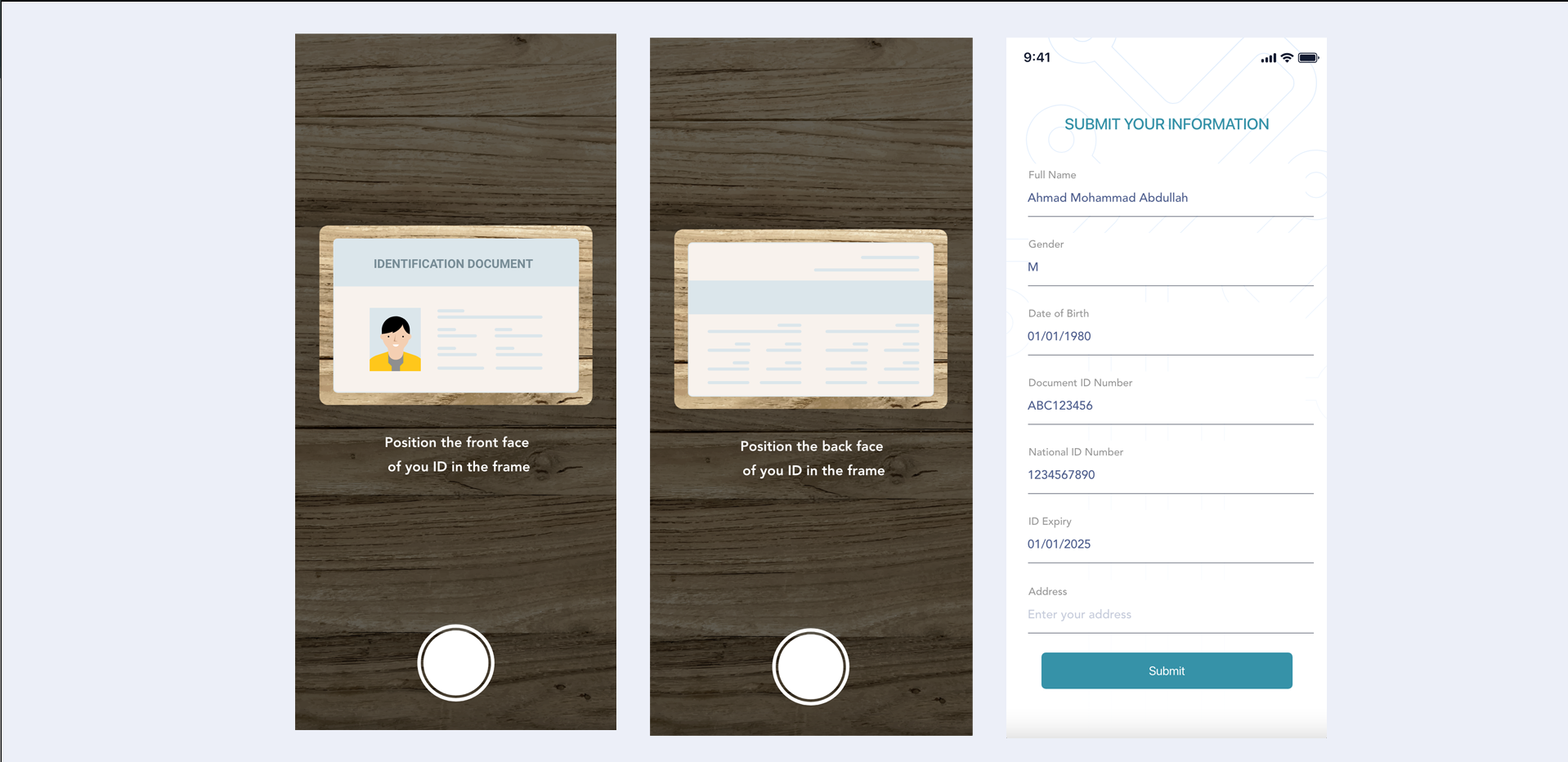

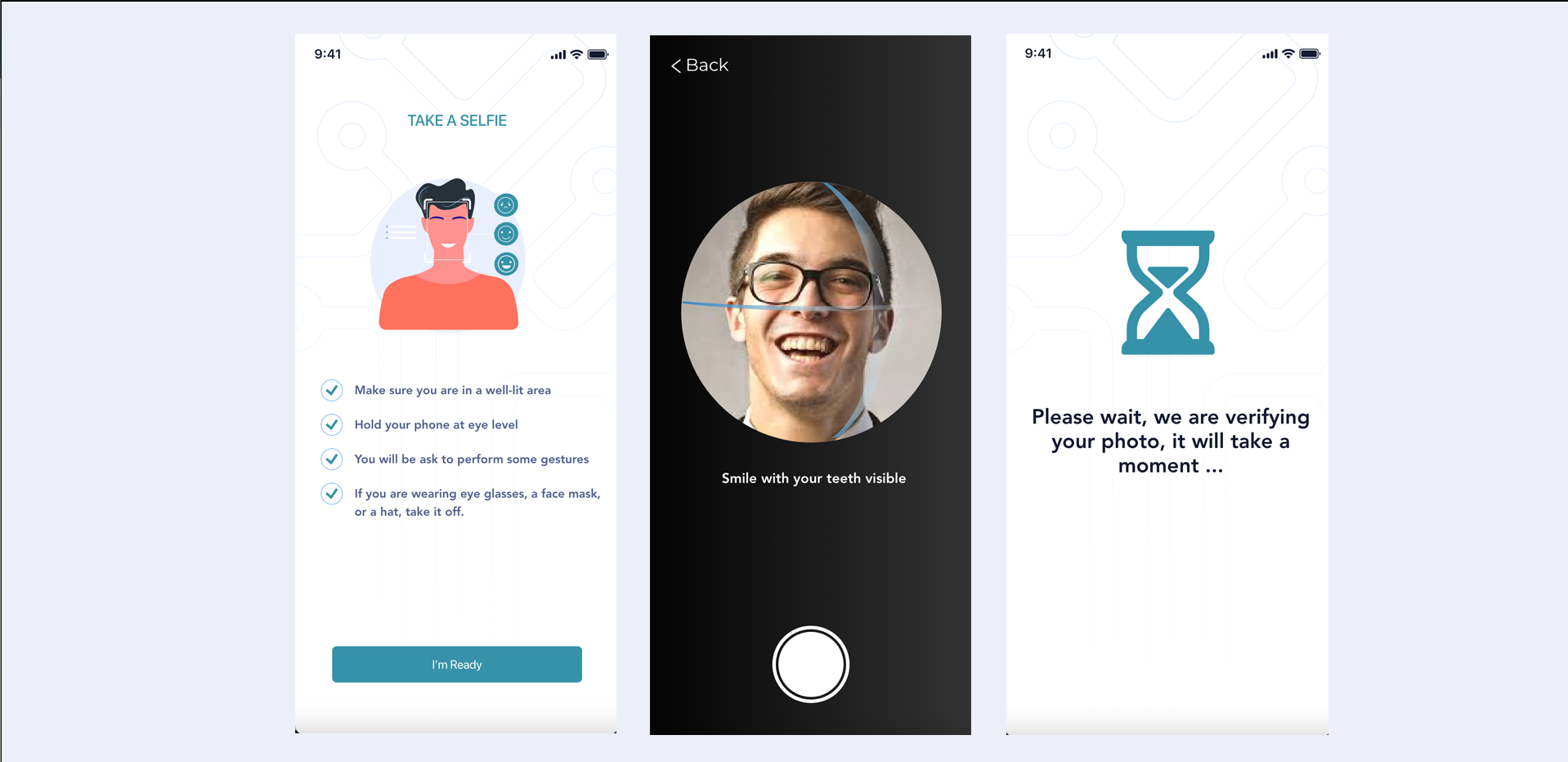

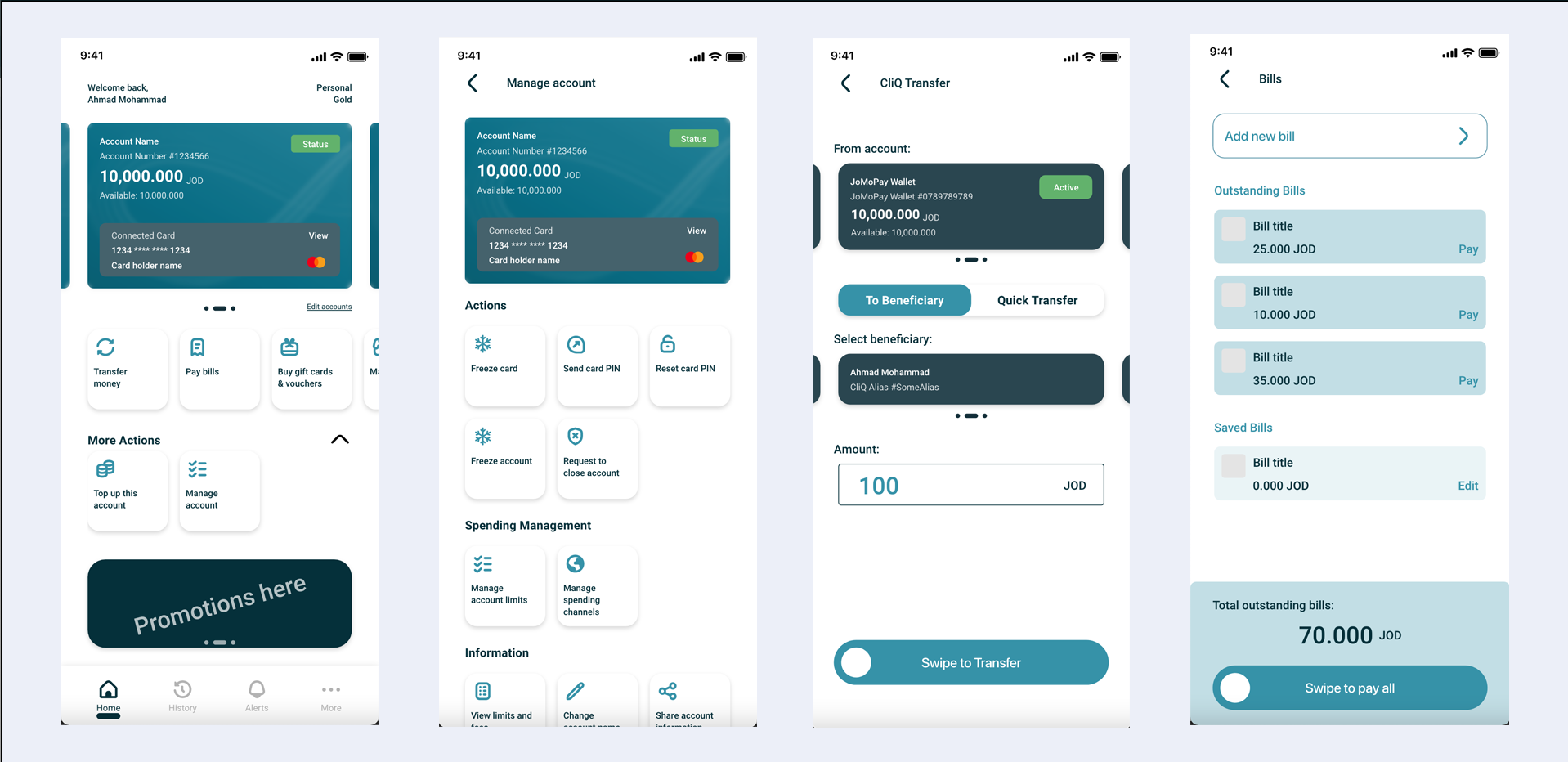

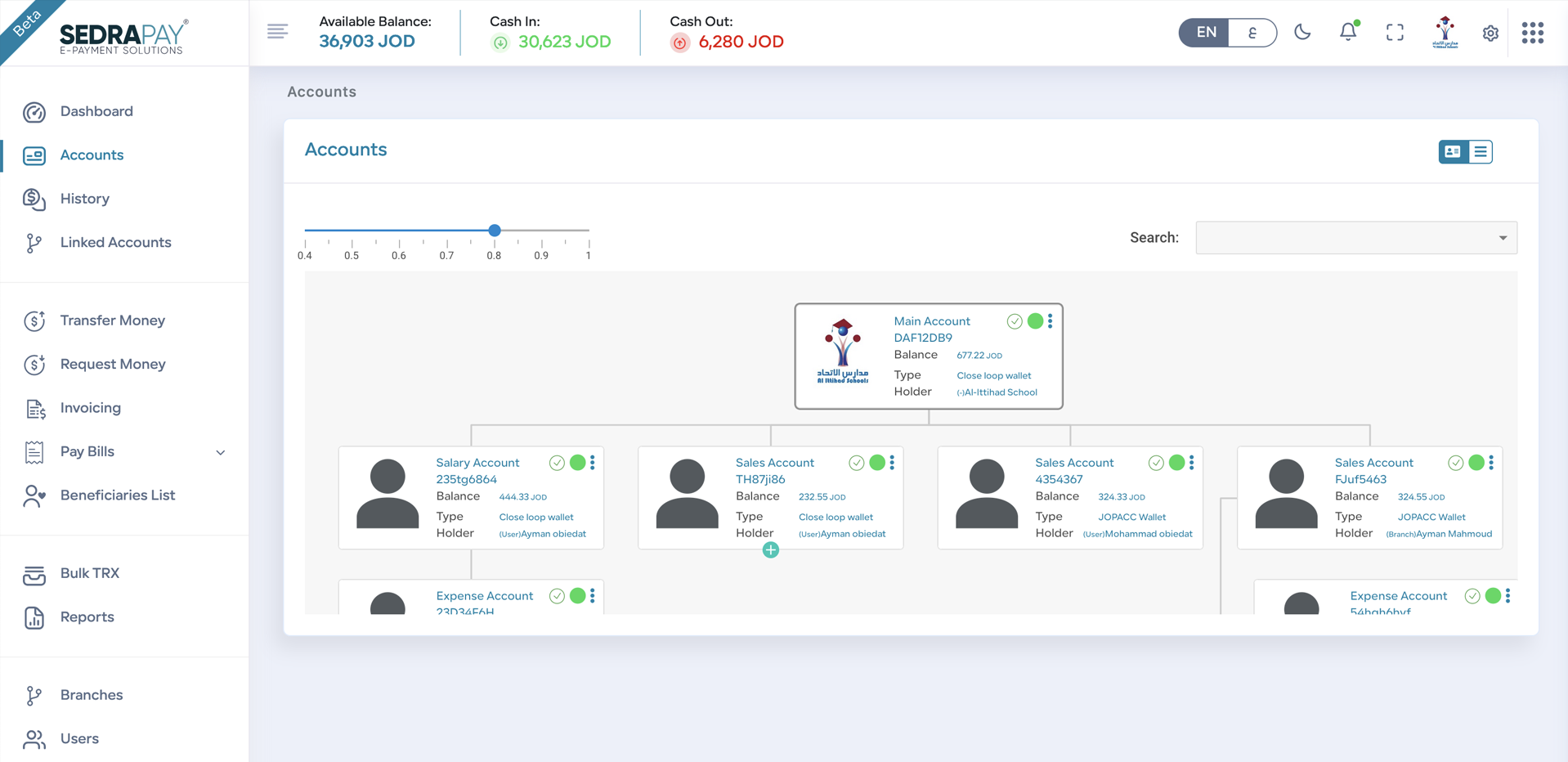

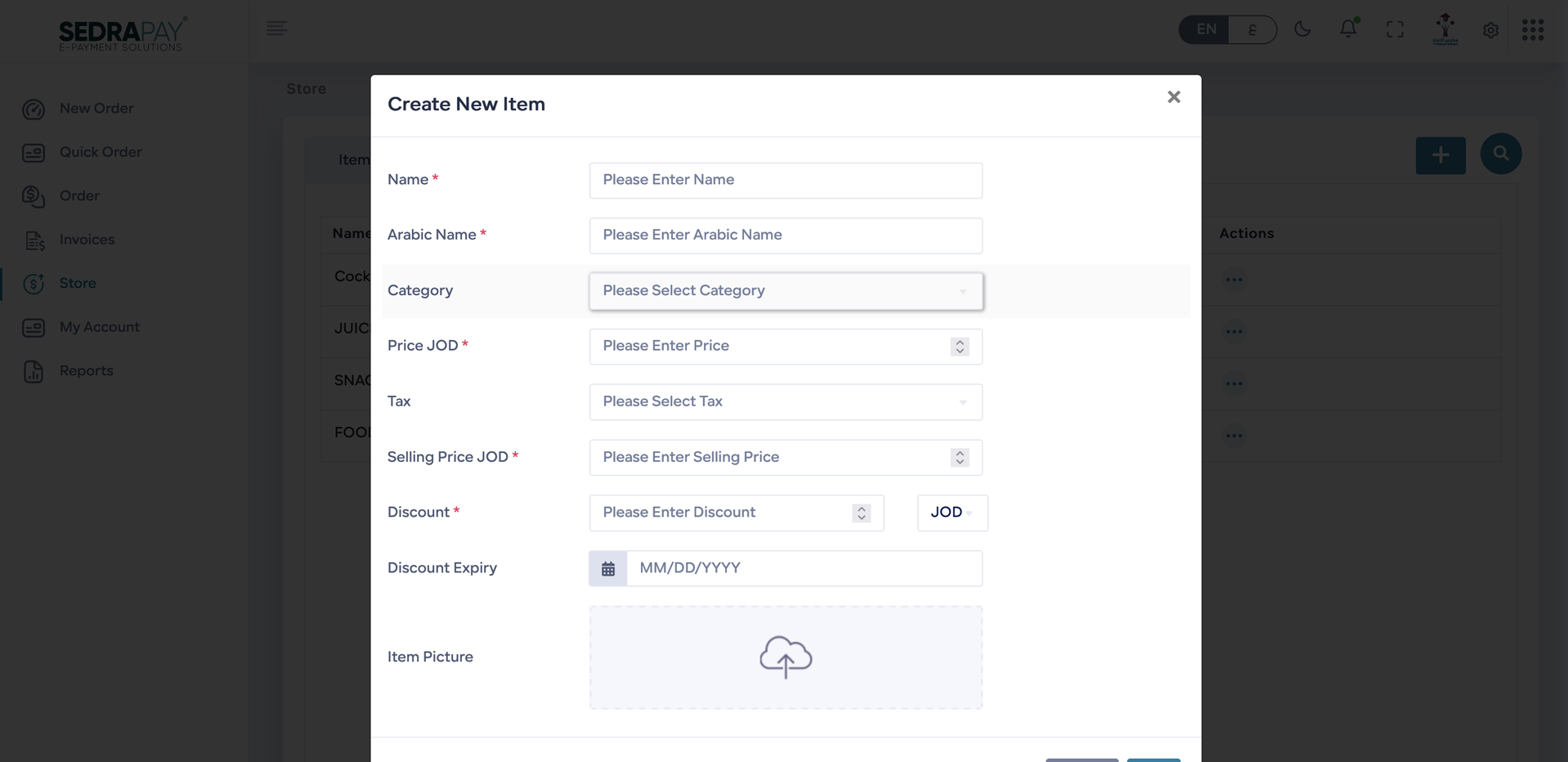

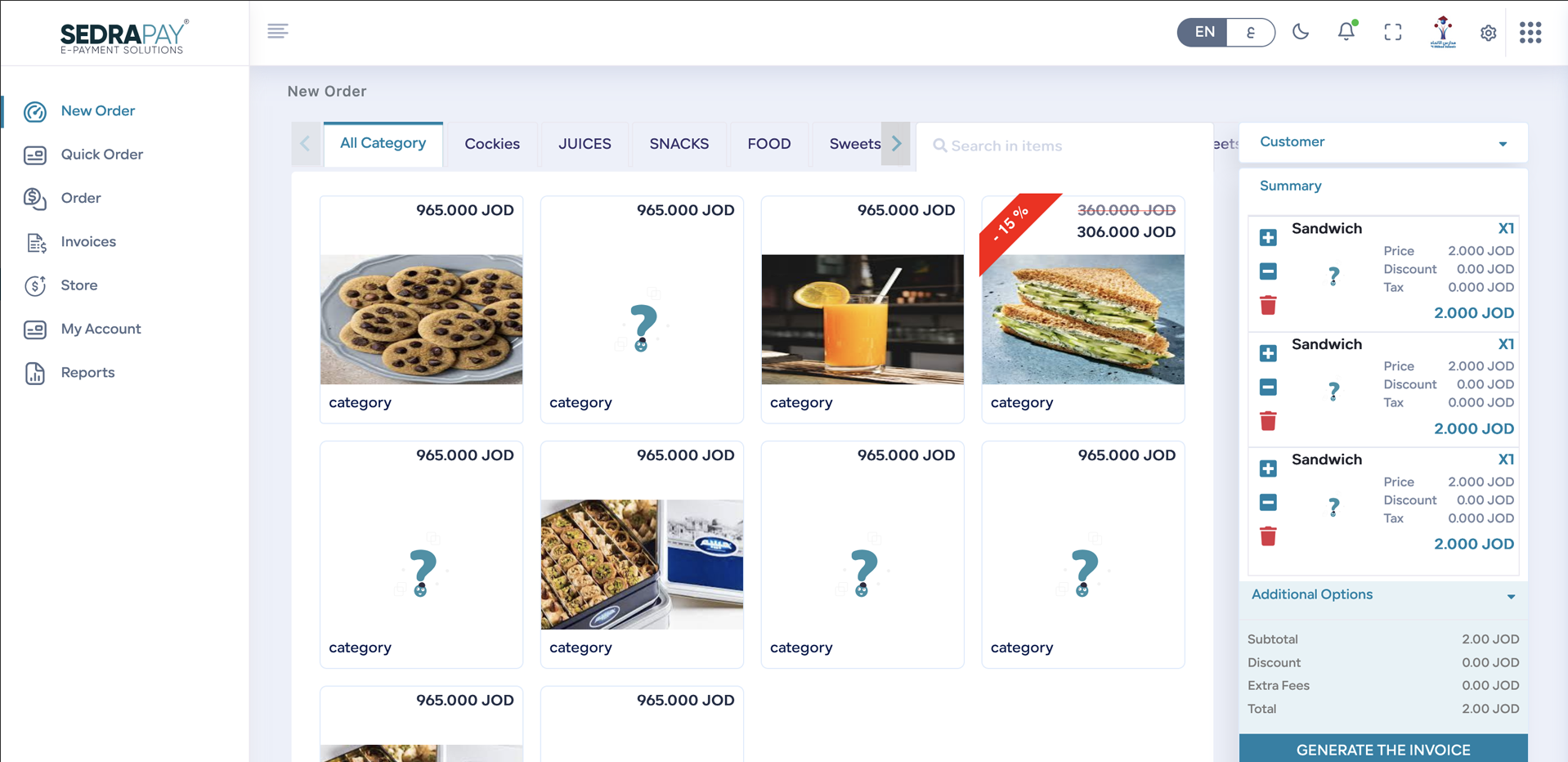

Build Your Fintech Solution in Weeks!

At SEDRAPAY, our mission is creating an effective and professionally designed tools, including components and open APIs, built on the latest technologies and micro-services architecture, allowing clients working in payments and fintech to create web and mobile apps with a rich interface and fast performance with minimum time and effort.

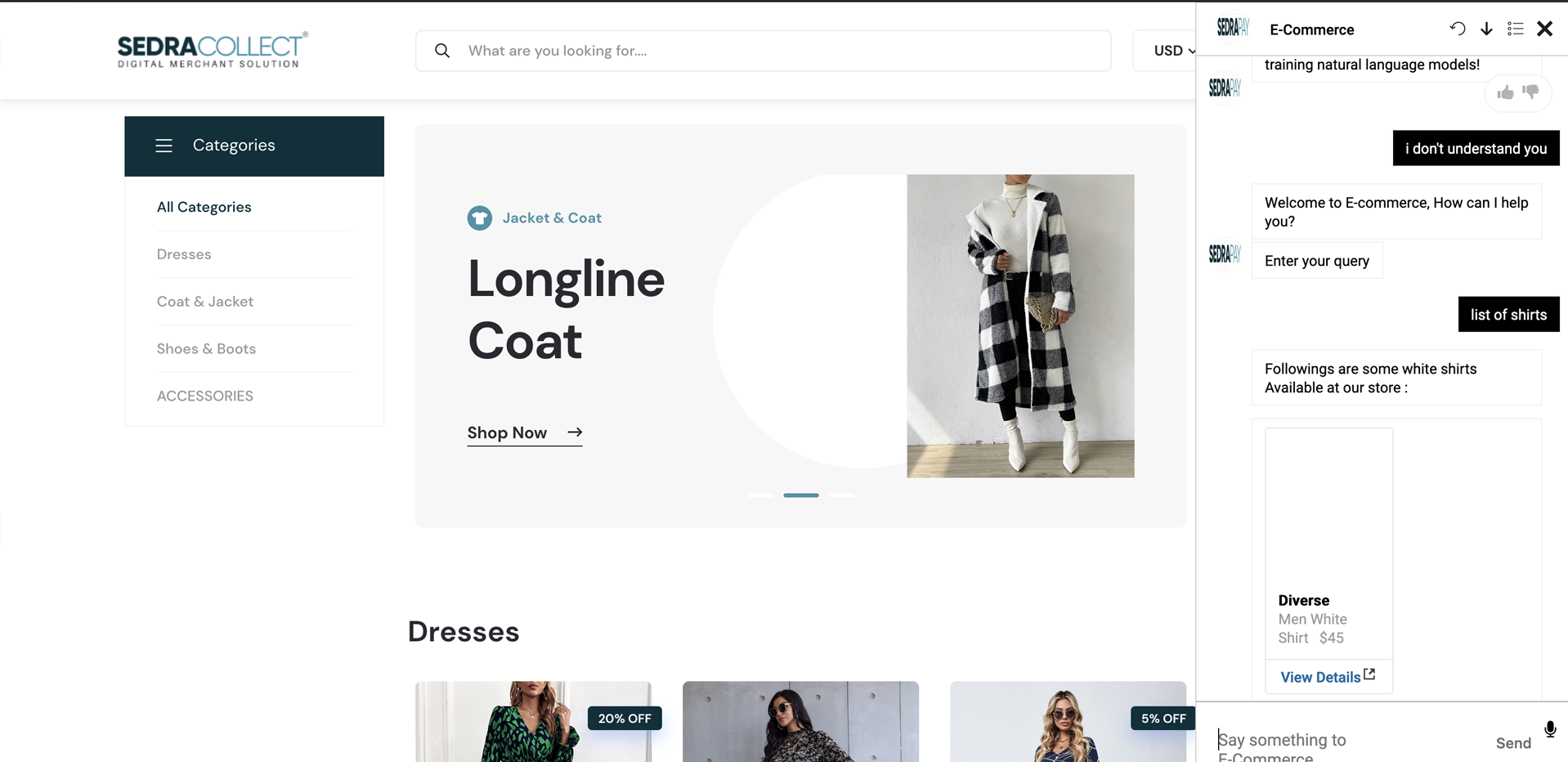

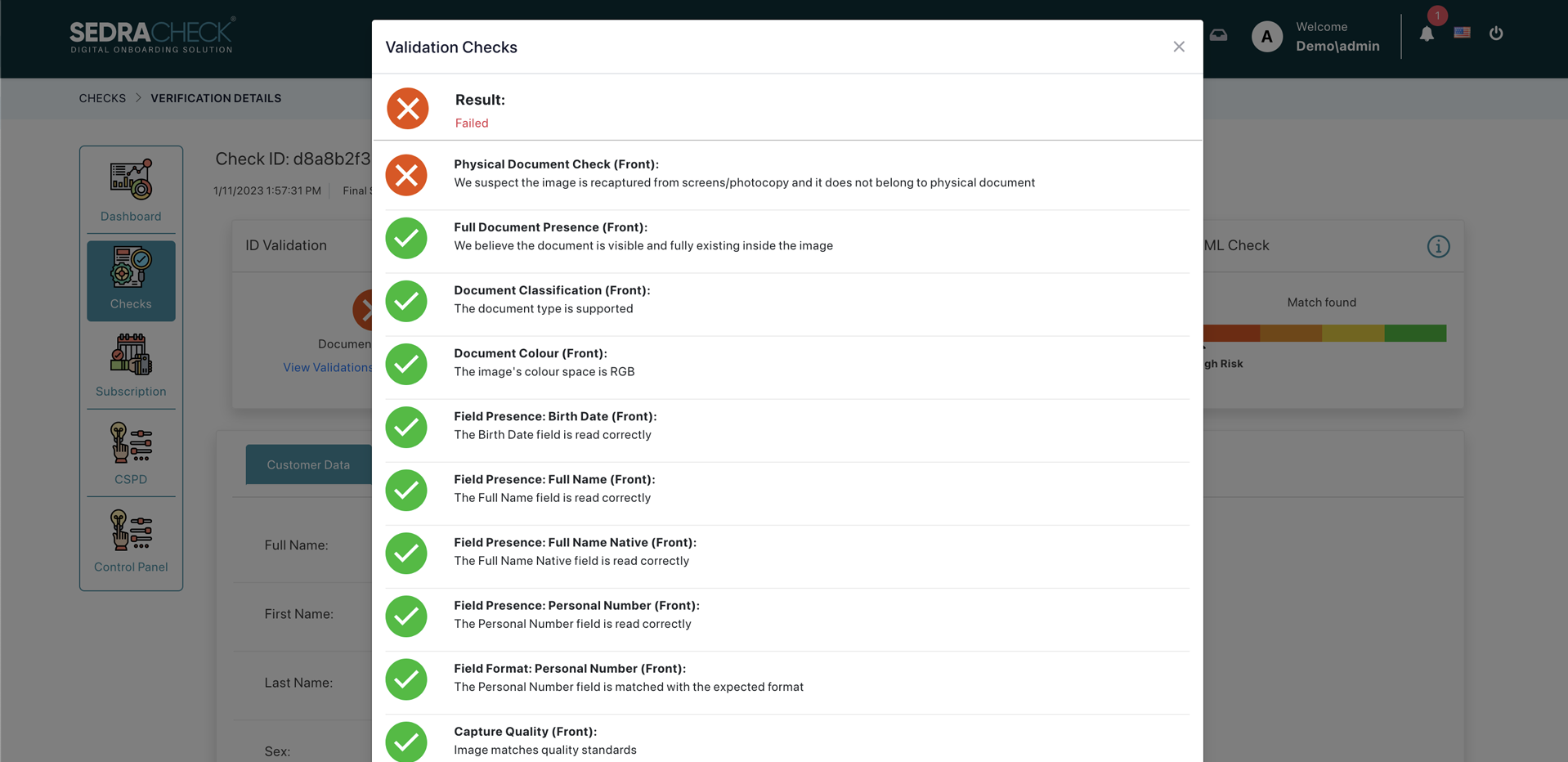

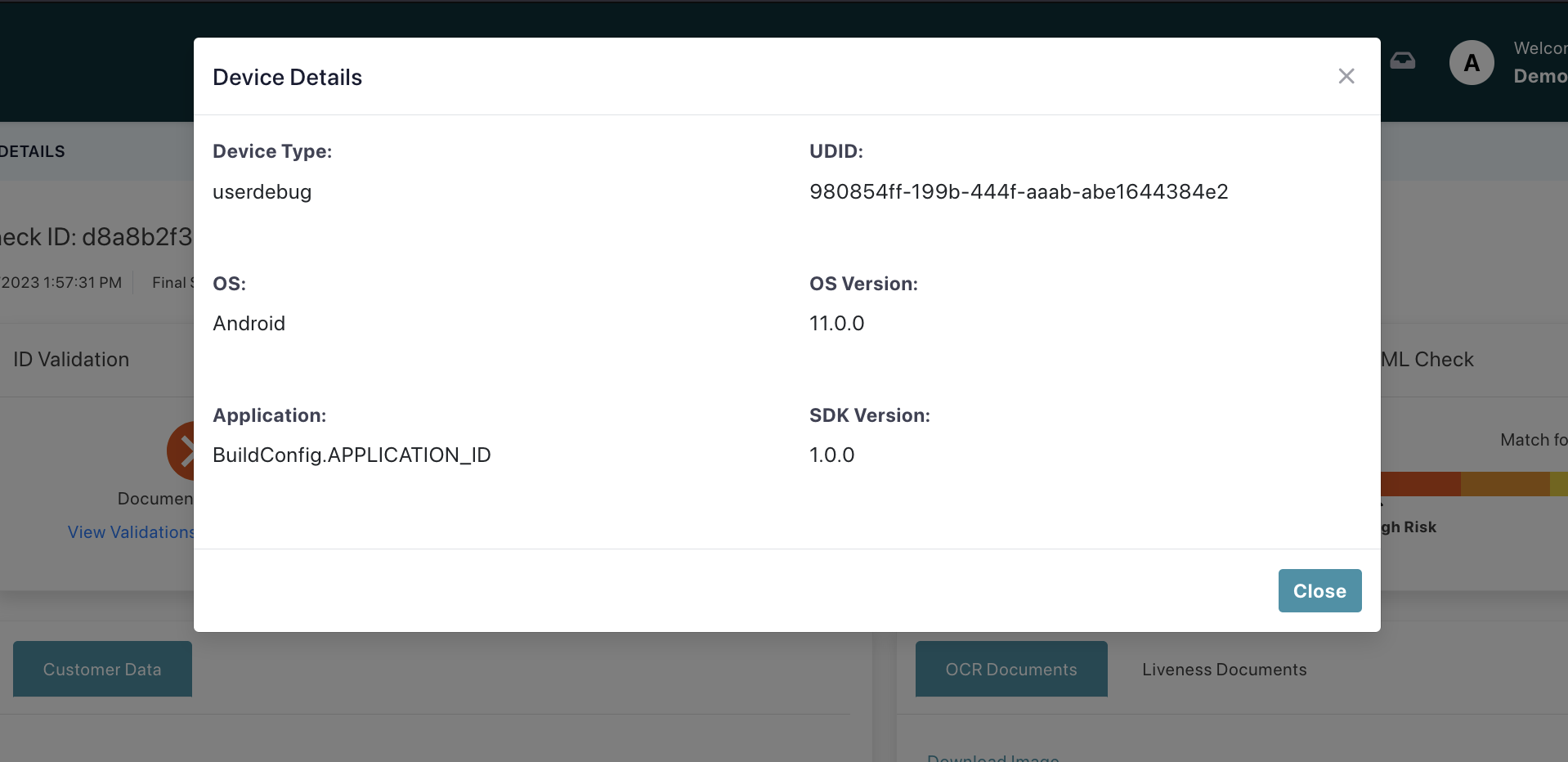

AI Experts… Driving Innovation and Efficiency for Your Business

AI-powered solutions for smarter decision making and increased efficiency.

Powerful Smart Engines for Streamlined Business Operations

Leverage the power of machine learning to gain valuable insights from your data and make smarter decisions.

Data-Driven Insights for Business Growth

Analyze your clients’ behavior to enhance performance, eliminate fraud and drive growth.